This Week in Crypto 14.08.23

- kathleenburkhalter

- Aug 14, 2023

- 4 min read

BTC and ETH have dipped below support levels of 29k and 1850 respectively, but continue to consolidate within a tight range. Short-term implied volatility has decreased to the low 30s, with realized volatility even lower. BTC volatility, slightly higher than ETH's, factors in the potential approval of a spot ETF.

As expected, 21shares & ARK Bitcoin ETF has been rejected by the SEC last Friday and investors are keenly awaiting some deadline this week: August 15th: Grayscale GBTC conversion lawsuit SEC deadline (Bloomberg estimate) and the impending Mt Gox distributions August 16th: Genesis bankruptcy mediation final deadline

September 3rd: Blackrock Bitcoin ETF application deadline.

Altcoins are facing pressure due to various FUD factors, including the resolved Curve exploit, upcoming token unlocks worth $180mm+, and profit-taking on catalyst-driven performers like XRP, LTC, etc . 2 weeks ago, Curve, the second-largest decentralized exchange (DEX), faced a substantial exploit, resulting in approximately $50 million being drained from several of its pools. This incident poses a potentially significant setback for the DeFi space and we believe is likely to reduce liquidity in the short term.

Flows in major cryptocurrencies have displayed relative equilibrium, with both buyers and sellers engaging in passive trading– with no clear appetite to move prices in one direction. Furthermore, the market sentiment towards altcoins has shifted towards better selling prospects; however, the overall trading activity in this segment remains subdued.

KPMG issued a report titled “Bitcoin’s Role in the ESG Imperative”. It’s an important milestone for the industry as it’s the first time a mainstream financial institution makes a deep dive into the frameworks of ESG and highlights that Bitcoin provides a number of positive benefits.

E: beginning with the environmental KPMG says the mining industry “is focused on driving towards Net Zero emissions.”

S: The social aspect of the report mentioned the opportunities the protocol presents for financial inclusion

G: KPMG addresses the governance aspect of Bitcoin, and the decentralized aspect of the network specifically, which it writes is one of its “most prominent features.” The report acknowledges that the network’s rules cannot be changed or modified by those in power, pointing to a “robust” governance structure that provides a “high degree of confidence” in the overall system.

Picture of the week

Sam Bankman Fried has been sent to jail for witness tampering.

NFT Market News

by Gerard Barile, Principal

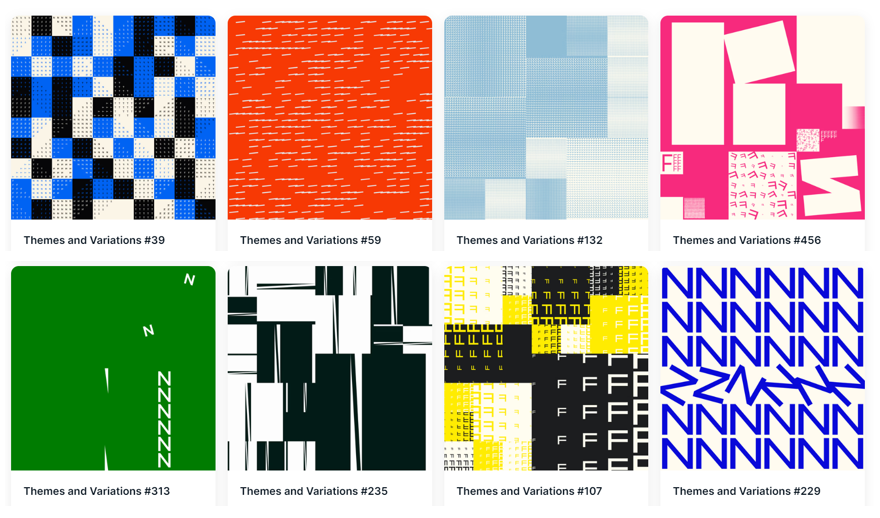

Vera Molnàr NFT auction at Sotheby’s generates USD 1.2 M

The NFT collection of Vera , pioneer in computer art, named 'Themes and Variations,' was a collaboration with artist and coder Martin Grasser and featured 500 unique digital artworks. The auction was conducted by Sotheby's, and each NFT was sold for 631 ETH, equivalent to $1,178,520. Vera Molnár explored N F T letters in this project, adding a personal touch to her generative art. The NFT collection is a testament to her groundbreaking work in the art world. Within these works, Molnár passionately explores ideas she has delved into since the late 1960s when she first embarked upon the realm of algorithmic art.

Beeple Purchases CryptoPunk

Acclaimed digital artist, Beeple, recently ventured into profile-picture NFTs, procuring the distinct CryptoPunk #4593 for 113.7 ETH or $208,000. This CryptoPunk stands out for its unique clown like appearance, notably with the clown nose and clown eyes green traits. Before this acquisition, Beeple crowdsourced advice on Twitter for the ideal punk choice, and his audience eagerly responded. Following the purchase, Beeple unveiled a digital artwork titled "A Punk Is Born," showcasing himself styled as his new NFT. This acquisition highlights Beeple's appreciation for the transformative impact of NFTs, especially CryptoPunks, in redefining a move toward digital identity and ownership.

Latest News

by Sam Eisner, Associate

Worldcoin, the controversial crypto project co-created by OpenAI's Sam Altman, founder of Chat GPT announced the launch of its WLD token last week, following the project’s completed migration to the OP Mainnet. The project is among the crypto sector’s most divisive. Its focus is on helping people prove their identity online with credentials verified in person by iris-scanning orbs. More than two million people have already been verified, and all of them stand to receive their share of the WLD token. The project aims to function as a fairly distributed cryptocurrency using biometrics as the basis of its distribution scheme. Worldcoin ($WLD) is down 25% over the last 7days.

PayPal (PYPL) announced the global payments giant is issuing its own U.S. dollar-pegged stablecoin. The Ethereum-based token will soon be available to PayPal U.s. users and is the first time a major financial company is issuing its own stablecoin.

Coinbase launches BASE a decentralized blockchain. What you need to know about BASE : ➡ Base is an Ethereum Layer 2 scaling solution built using the open-source Optimism stack. ➡ It is designed to deliver the security and scalability of Ethereum at a fraction of the cost. ➡ Many protocols have already announced their official launch on Base. ➡ Coinbase is sitting on cash and is a big player in the field $COIN.

REGULATORY ROUNDUP:

Following multiple setbacks with European regulators, Binance has become the first digital asset exchange to receive an Operational Minimum Viable Product (MVP) license from Dubai’s Virtual Assets Regulatory Authority (VARA). The news comes as the exchange faces regulatory challenges in several The Operational MVP license, issued to the Dubai subsidiary, Binance FZE, allows the company to offer regulated virtual asset exchange services under VARA’s investor protection and market assurance standards.

*PLEASE SEE IMPORTANT DISCLOSURES BELOW*

DISCLOSURE:

The opinions expressed herein are those of the author alone and do not represent Wave Digital Assets LLC or any of its affiliates. The author may hold investment positions in some of the assets discussed.

Nothing in this email or linked information should be interpreted as an offer or recommendation to buy, sell or hold any security or other financial product. Wave is federally regulated by the US Securities & Exchange Commission as an investment adviser. Registration with a federal or state authority does not imply a certain level of skill or training. Additional information including important disclosures about Wave Digital Assets LLC also is available on the SEC’s website at www.adviserinfo.sec.gov.

.png)

Comments